To learn more about this unique 3rd party manager’s strategy, click on the following link:

https://advisorsharewm.com/2x-dual-directional-manager

I’ve been trying to work with this manager for three years and he finally agreed to allow us to use his strategy on our RIA platform and our soon-to-be launched TAMP.

2x Dual Direction Tactical SPY/Nasdaq 100 strategy

How can a manager generate a 75% return when the SPY was up 26% and the Nasdaq up 55% (combined average = 40%) in 2023?

–First, this manager uses a 50/50 split of the 2x SPY index and the Nasdaq 100 index. So, when those two indexes are up, his strategy is up 2x (technically up 1.97x with the indexes used).

–Second, this manager is dual-directional. He can use a 2x inverse index to capture returns to the downside.

–Third, this manager can also simply sit in high-yielding money markets when his signals indicate it is time to be out of the market.

*The 75% return is net of a 1% fee.

Isn’t a 2x dual directional strategy “risky”? It would be without risk management. This manager has several different rules that are followed to provide bull/bear/neutral investment decisions. To learn about the rules and how this strategy is managed, sign up to attend the webinar (live or on recording).

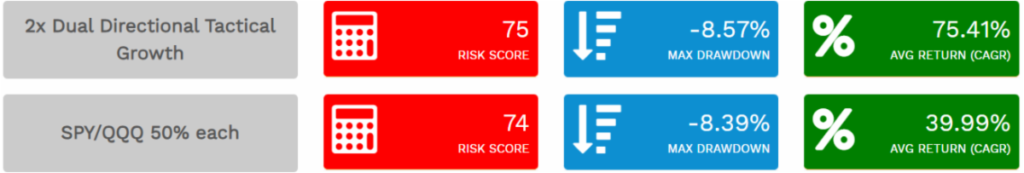

2x Strategy vs. SPY/QQQ 50% Split

As you may know, I’ve spent the last several years building OnPointe Risk Analyzer (a more accurate and better sales tool than Riskalyze). Let’s look at a comparison from OnPointe of this 2x tactical strategy vs. an SPY/QQQ combo. Here are the numbers for 2023.

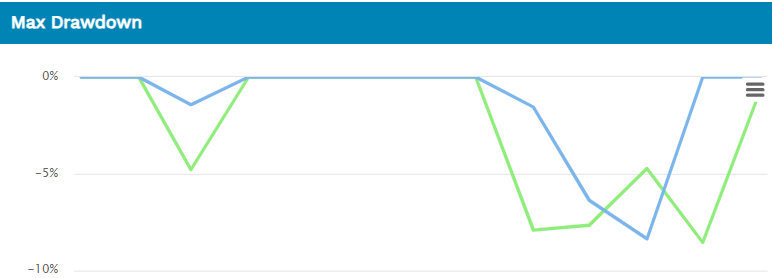

The following is the drawdown chart from 2023. As you can see, the dual directional manager (green line) has a period of positive returns when the SPY/QQQ combo was negative. What’s equally as interesting is when the SPY/QQQ combo was down, the tactical strategy was down about the same.

10-Year Historical Comparison

The 10-Year Calmar Ratio (risk-adjusted return ratio) is:

2x Dual Directional Tactical Growth = 2.15

SPY = 0.53

So, much better “risk-adjusted returns” than the SPY/QQQ combo.

Yes, these numbers look gaudy and somewhat hard to believe. Well, that’s why fiduciaries do their due diligence on strategies to determine if they are viable and should be used. It’s my role to find managers, vet them, and if good, let advisors know about them.

FYI, even though the manager has been running this strategy for 20+ years, like ALL good signal-driven strategies, this one has evolved over time. The goal is always to use more/better data when available. The 10-year numbers use the manager’s current group of signals.

How to Use a Super Alpha 2x Dual Directional Manager?

Once approved for use, then the question is what’s the best way to use it? At our RIA and in the TAMP, we will use this strategy for 5-20% of a client’s money in our multi-manager portfolios.

The following are the 10-year historical returns of a few of our RIA’s multi-manager portfolios where we swapped out what we think is a good growth strategy with this 2x dual directional strategy. Pretty interesting, eh?

The multi-manager numbers are net of fees.

Conclusion…it’s difficult to find good tactical managers. I’ve been after this manager for three years and I’m glad we are now able to use him on the TAMP, our RIA platform, and for other advisors who may want to use his strategy as well. I recommend you do your due diligence to see if this manager is one that can help you onboard more AUM In 2024.