If you would like more info on this unique Fixed Indexed Annuity, click on the following:

If you missed last week’s newsletter, to download Ken’s 14-page “Annuity Insights” consumer guide, click on the following:

https://advisorshare.com/fia-90-day-reset

Insurance companies are always looking for a marketing twist to their products to make them more appealing. Most of the time I think these twists are mostly smoke and mirrors.

The twist discussed herein has real value and can save advisors a lot of heartburn.

How does the 90-Day Low Point reset work?

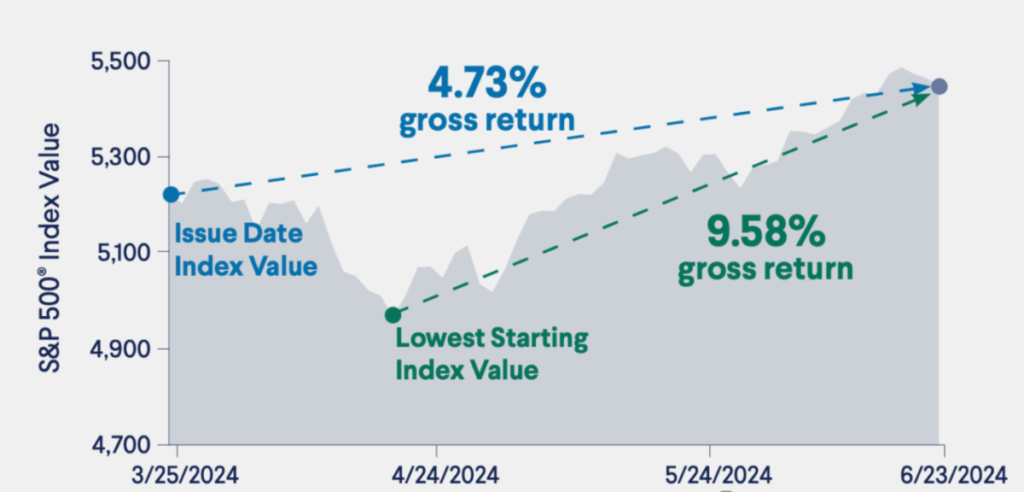

After the FIA is issued, if the market goes down within 90 days of issue, the product will reset the starting value for the first year’s annual pt-to-pt bucket.

Gimmick or Real value?

The product was back tested to 1978 and run through 11,641 different starting points.

90% of the time there was an improvement to the starting value within 90 days.

2.96% there was an improvement to the starting value within 90 days.

This product will help advisors save face when talking with the client about the return credited at the end of year #1.

2024 example—look at the difference for a client if they purchased it in March of 2024.

Cringing when the market tanks after selling an FIA!

There is no worse feeling than selling an annual pt-to-pt crediting FIA and then having the market drop significantly right after issue. You know that your discussion with the client at the end of year one will be talking about the FIA crediting ZERO!

If an early downturn happens with this FIA, the advisor will get a big smile on his/her face because the likelihood of a much higher return at the end of year #1 goes up dramatically!

While no product is perfect, this one is pretty interesting and one you may want to discuss with clients who are candidates to use FIAs to grow wealth in a protected manner.

E&Y Study: The Benefits of Integrating Insurance Products into Retirement Plans

If you missed my recent newsletter, click on the following to download the E&Y study.

This is the conclusion from Ernst & Young:

Using an “investment-only” strategy is inefficient from a

retirement income and legacy perspective.

To download this 18-page study, click on the following link:

www.advisorshare.com/ey-retirement-income-study

FYI, the concept of “buy term and invest the rest” is blown up in this study!