A lot of advisors use Social Security (SS) “timing” as a lead gen tool to get in front of new clients (in-person seminars, Facebook marketing, etc.).

While the topic has become less fun after the somewhat recent rule changes, it’s still a topic that confronts EVERYONE when they turn age 62.

We’re rolling out so many new OnPointe Retirement Planning software features (IRMAA penalty calc and the industry’s only accurate Roth IRA Conversion app), that I forgot about how easy it was to help clients decide what age is best for them to turn on their SS payment.

I created the numbers in this newsletter in OnPointe. It took only a few minutes. If you have not switched to OnPointe yet and want a live demo, click on the following:

https://onpointesoftware.com/retirement-planner-demo

Example couple who wants to retire at age 62

Married couple, both age 61

Life expectancy of age 88

$1,000,000 in a tax-deferred IRA

$600,000 in a Non-Qualified (NQ) brokerage account

$110,000 in expected expenses starting at age 62

4.5% NET investment rate of return in retirement

The following are their joint annual projected SS income benefits:

Turn SS on at age 62 = $43,110

Turn SS on at age 66 = $61,176

Turn SS on at age 72 = $86,323

At age 88, here is the financial outcome depending on when they turn on SS benefits:

Turn SS on at age 62 = $109,025 left in the IRA

Turn SS on at age 66 = $212,544 left in the IRA

Turn SS on at age 72 = ran out of assets at age 85

When people take SS at age 72, they are forced to spend much more money from their IRA/NQ brokerage account. When doing so, you lose out on significant compounding growth from investment accounts, and that is why they run out of money early when taking SS late at age 72.

More affluent client—Let’s take the same client and increase their NQ brokerage account from $600,000 to $1,000,000. Let’s see the number at their life expectancy of age 88.

Turn SS on at age 62 = $1.61 million in the IRA

Turn SS on at age 66 = $80k in the NQ account and $1.72 million in the IRA

Turn SS on at age 72 = $1.07 million in the IRA

As you can see, it’s a similar outcome (best when turning SS on at age 66).

Age of Assumed Death is the 2nd Key Factor

What the previous examples indicate is that the amount of money a client has doesn’t really affect the outcome (meaning which year is best to turn on SS income).

Let’s look at the 2nd client and change the age at which they die.

Let’s assume both spouses live to age 93.

Turn SS on at age 62 = $899,040 in the IRA

Turn SS on at age 66 = $1.158 million in the IRA

Turn SS on at age 72 = $500,772 in the IRA

What about an even more affluent example? Let’s assume they have $2 million in their NQ brokerage account (their expenses remain the same) and live to age 93.

Turn SS on at age 62 = $3.8 million in the NQ account and $1.32 million in the IRA

Turn SS on at age 66 = $4 million in the NQ account and $1.32 million in the IRA

Turn SS on at age 72 = $3.47 million in the NQ account and $1.32 million in the IRA

Last example—what if they both die at age 83?

Turn SS on at age 62 = $817,390 in the IRA

Turn SS on at age 66 = $774,064 in the IRA

Turn SS on at age 72 = $228,208 in the IRA

This last one is interesting. When the client dies early, taking SS early worked out best.

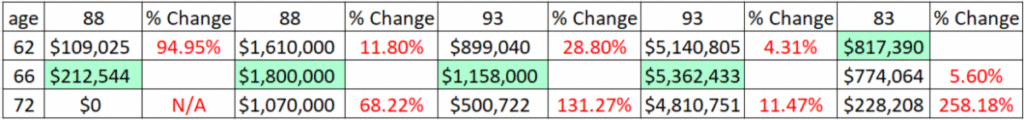

The following is a chart of the percent decrease in asset values between the best scenario and the other two (the following are in order of the examples above).

Different Variables

Variables like how much tax-deferred vs. NQ-account money and a Roth IRA conversion can make a big difference in the outcome. The good news is that our OnPointe Retirement Planning software takes ALL of these variables into consideration when running client fact patterns. So, you know that your SS timing numbers will be as accurate as possible.

Why Bonus FIAs to “Pay the Tax” on Roth Conversions are a Failure (White Paper)

To download my 14-page White Paper detailing specifically why using a 20% bonus FIA(Fixed Indexed Annuity) to “pay the tax” does NOT work, click on the following link:

https://advisorshare.com/bonus-fias-roth-failure

Bonus Webinar—On Recording

If you sign up for the download, you will also get access to the webinar where I explain why this concept doesn’t work!