To download this 24-page study by Corebridge Financial, click on the following:

www.advisorshare.com/longevity-study

Living to Age 100

This study is about the possibilities of living to age 100 and the thoughts of those surveyed on how prepared they are if that happens. It’s a great study that can be used to motivate clients to take action!

In a nutshell, the study says:

– 51% of non-retirees believe they could live to 100

– 80% expect to retire by age 69 (including 34% who plan to retire by age 64)

– Yet 50% are only planning for 20 years or less in retirement

This disconnect between how long people think they COULD live and the years financially they are planning to live is HUGE!

New Life Expectancy Calc Helps Advisors Dial-In Realistic Retirement Plans

A few weeks ago, I did a newsletter about our OnPointe retirement planning software Life Expectancy (LE) calculator. It’s really cool and fits perfectly with this new study and the need to help clients understand their “true” LE (which can be done using the new calc).

Try the LE Calculator for Yourself

The number of centenarians in the US is expected to quadruple to more than 400,000 by 2054.

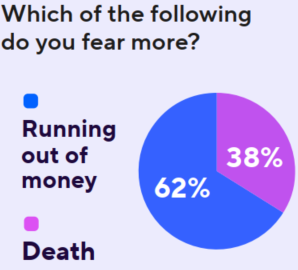

7 in 10 say running out of money is their top financial worry (2/3 fear running out of money more than they fear death).

73% say uncertainty about how long they will live is a TOP retirement planning challenge.

The disconnect is clear. Many non-retirees believe they COULD live to age 100, but most are NOT taking financial planning steps to live that long.

As such, longevity planning MUST be pushed to the forefront of retirement planning.

Opportunity—longevity planning is an opportunity to further relationships with clients!

Items That Respondents Said Provide the MOST Financial Confidence No Matter How Long They Live

1) Having a source of guaranteed monthly income in addition to Social Security

2) Knowing that Social Security will be there for as long as they need it

3) Having a detailed plan for funding essential and discretionary expenses in retirement

4) Working with a financial professional

More on Guaranteed Income

3 in 4 say having a guaranteed lifetime income you can’t outlive, in addition to Social Security, would positively impact their:

1) Ability to spend money on the things that make them happy

2) Current level of happiness

3) General retirement outlook

4) Ability to manage retirement concerns

Guaranteed Income-for-Life Products for the Affluent

26-Page White Paper

If you missed this newsletter a few months ago, you missed the opportunity to download one of the best white papers I’ve written in 25 years. To download, click on the following link or image:

https://advisorshare.com/gib-rider-white-paper

Fear Running Out of Money More Than Death

I think the above chart from the study says it all. There is no bigger fear for most clients than running out of money in retirement. Advisors can justifiably use this fear to motivate clients to take action to sit down with an advisor to map out their retirement plan.