To download this annual survey (43 pages long with several great stats with charts/graphs that just came out June 25th), click on the following link:

https://advisorshare.com/ebri-2024

I’m speaking at the annual Financial Planning Association conference in Columbus, OH, September 18-20 this year. My session is on Asset Protection Planning. If you are attending the seminar, please feel free to email me back and let me know (I’d like to say hello in person).

The Employee Benefit Research Institute (EBRI) puts out an annual survey each year that has a lot of useful information. Active workers and retirees are surveyed, and their answers are broken out so you can see what workers think will happen and what retirees state has actually happened.

Empower America Data

This year I found a presentation that has both the EBRI info, but also several slides with info from Empower America. Their retirement survey info is equally if not more interesting than the EBRI data.

Below I highlight some of the items from these surveys that I found the most interesting.

-ONLY 2 in 10 workers are VERY confident they will have enough money to live comfortably in retirement.

-Define financial happiness:

- 67% (Paying bills on time/in full)-67% (Paying bills on time/in full)

- 65% (Being debt-free)

- 54% (Enjoying ‘everyday’ small luxuries without worry)

- 53% (Being able to afford experiences with loved ones)

There are 8 additional items in the survey not listed here.

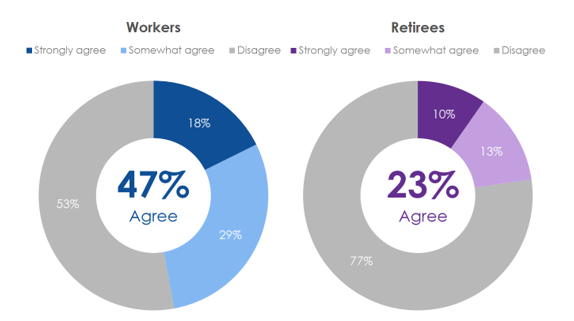

Does debt negatively impact your ability to save for life in retirement?

Financial priorities of the different generations

-Expected vs. Actual Retirement Age

Over 50% of workers expect to retire at age 65 or older while 70% of retirees did so before age 65.

-Given TODAY’s economic environment, when do you think you will retire?

Gen X respondents last year said age 63. This year they said age 65!

-52% of retirees say their expenses are higher than expected.

-Over 1/3 of workers DO NOT know where to go to get financial/retirement planning advice.

-52% know what their financial goals are, they just don’t know how to get there.

-8 in 10 workers are interested in using guaranteed income for life products!

Employer wish list

- 54% of employees wished their employer auto-enrolled them into a 401(k).

- 44% wished their employer offered one-on-one financial help/coaching.

- 67% believe their employer has a responsibility to help with financial planning (especially if they offer a 401(k)).

What can you do with this survey data?

One thing you can do is give a copy to your client/potential clients. It has a lot of thought- provoking info.

The survey can help facilitate discussions with your clients/potential clients.

You might take away from it areas you need to focus on, i.e. helping clients manage their debt, talking about and using guaranteed income products, etc.

In the middle of summer when many advisors are taking some time off, to be able to flip through a survey that has many colorful charts with interesting info shouldn’t be too taxing!