This is the conclusion from Ernst & Young:

Using an “investment-only” strategy is inefficient from a

retirement income and legacy perspective

To download this 18-page study, click on the following link:

www.advisorshare.com/ey-retirement-income-study

FYI, the concept of “buy term and invest the rest” is blown up in this study!

As I was doing research for 3rd party studies on income rider annuities, I came upon this E&Y Study that I found very interesting (and I think you will too).

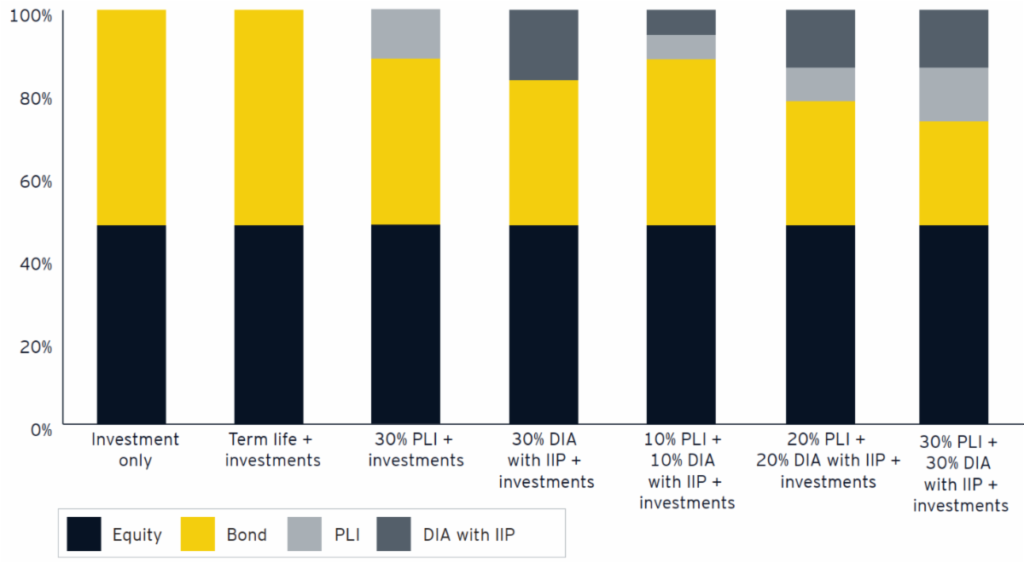

What does the study do? It creates simulations for clients of various ages where they invest in various options and then compares cash flow in retirement and legacy value for the heirs.

The following is a chart of the various allocation options:

PLI = cash value whole life insurance

DIA with IIP = deferred income annuity with an increasing income component

Also, before I get into the numbers, the E&Y study used whole life insurance as the Cash Value Life (CVL) tool of choice. If E&Y had used IUL (Indexed Universal Life), the numbers would have been much more favorable (they are still favorable, but they would have been better).

25-year-old example

Investment-only lost to using CVL when it came to cash flow and legacy value.

“Buy term and invest the rest” lost to using CVL when it came to cash flow and legacy value.

The best outcome was when CVL and a guaranteed income rider annuity* were combined with investments (cash flow and legacy value were both increased). *The income rider annuity was purchased at age 55 to create retirement cash flow.

Just like using IUL would have generated a better outcome, if the client had used an FIA with a guaranteed income rider, there is no doubt in my mind that the numbers from this study would have been even more supportive of using a guaranteed income rider as part of the plan.

| Strategy | Retirement Income | % change vs. investment-only | Legacy at end of time horizon | % change vs. investment-only |

| Investment-only | $61,250 | n.a. | $3,015,937 | n.a. |

| 10% PLI + 10% DIA with IIP investments | $63,125 | 3.1% | $3,168,788 | 5.1% |

| 20% PLI+ 20% DIA with IIP investments | $64,063 | 4.6% | $3,382,146 | 12.1% |

| 30% PLI+30% DIA with IIP investments | $64,531 | 5.4% | $3,580,807 | 18.7% |

| 10% PLI + investments | $61,875 | 1.0% | $3,148,482 | 4.4% |

| 30% PLI + investments | $62,500 | 2.0% | $3,421,457 | 13.4% |

| 50% PLI + investments | $61,875 | 1.0% | $3,631,661 | 20.4% |

| 10% DIA with IIP + investments | $63,125 | 3.1% | $3,037,380 | 0.7% |

| 20% DIA with IIP + investments | $64,688 | 5.6% | $3,074,274 | 1.9% |

| 30% DIA with IIP + investments | $66,250 | 8.2% | $3,128,817 | 3.7% |

The study’s conclusion for a 35-year-old is similar to that of a 25-year-old.

The study’s conclusion for a 45-year-old is that the client would have done even better by allocating more money to CVL.

How can you use this study?

1) You can use this with clients to support your assertion that buying term and investing the rest isn’t what Dave Ramsey says it is.

2) Using CVL can increase both after-tax retirement cash flow and assets passed to the heirs.

3) Show that income rider annuities also increase retirement income and assets passed to the heirs.

I’m not sure what more you’d want out of a 3rd party expert study.

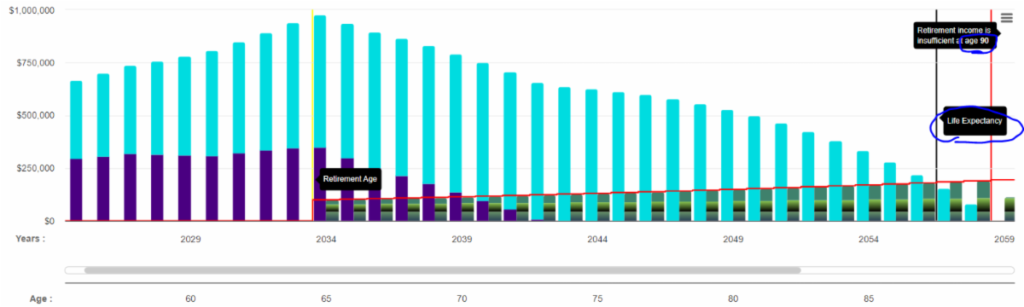

Best illustration software for GIB Rider FIAs

If you want to show your clients the power of using an FIA with a GIB rider, check out our OnPointe Retirement Planning software. OnPointe is light years ahead of programs like Retirement Analyzer, E-Money, MoneyGuide Pro, etc. when it comes to illustrating GIB rider products to clients.

If you want to watch a video of how easy it is to build an FIA with GIB in a client fact pattern and how that product extends their income in retirement, click on the following link:

www.onpointesoftware.com/income-riders