Why read this newsletter? It’s a great concept you can use to go after affluent clients!

For Info & to Download our Multi-Page Client Educational Piece

(Which can be personally branded to you!)

Click on the following to download this branded client piece:

Annuity Advanced Markets Q&A Download (it’s awesome!)

If you missed my newsletter back in February and didn’t download the 76-page advanced markets Q&A piece on annuities, click on the following to do so:

https://advisorshare.com/trust-owned-annuities

www.advisorshare.com/annuity-advanced-markets-q-a

Trusts and Tax Drag

Trusts are a common estate planning tool for passing and preserving wealth. However, income tax can be a problem for trusts due to the trust income tax brackets.

In 2025, a married couple filing jointly doesn’t reach the 37% income tax bracket until their taxable income exceeds $751,601.

However, a non-grantor trust hits the top tax bracket when income exceeds $15,651.

So, income generated in a non-grantor can get hit with much higher tax rates than the grantors who set up the trust and may be in a much lower personal income tax bracket.

This can create a large “tax drag” on trust asset growth, which reduces the amount of assets available to trust beneficiaries

Why use annuities in trusts?

Under IRC Sec. 72(u)(1), a trust that solely benefits living individuals can purchase an annuity and take advantage of tax deferral. This allows the annuity investment to grow tax-deferred (something not possible with most trust investments) and can result in a larger inheritance for trust beneficiaries.

The pass-in-kind opportunity

A pass-in-kind annuity strategy is a way to transfer an annuity contract from a trust to a beneficiary of that trust without a taxable event.

Under PLR 1999050152, the IRS allowed a non-grantor trust to transfer ownership of a deferred annuity in-kind to a trust beneficiary when the distribution is permitted by the trust. Regardless of the reason for the transfer, if the beneficiary is a living person with a beneficial interest in the trust, no tax reporting is required for this change in annuity ownership.

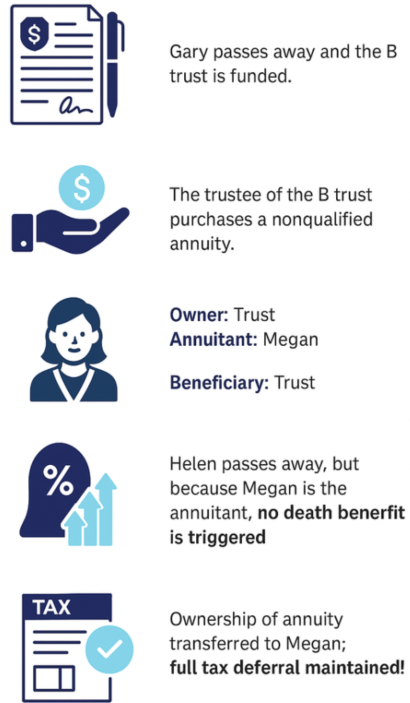

Example: Gary and Helen (H & W) set up A/B trusts for their estate plan where Helen is the “income beneficiary” of the B trust and Megan (their daughter) is the “remainder beneficiary.” Assume Helen could, but doesn’t trigger income distribution (leaving all trust assets to Megan at her death).

The following shows the progression of this advanced tax concept at Gary and Helen’s death.

The keys are:

1) The annuity assets are allowed to grow tax-free inside a trust.

2) When Helen dies, the ownership of the annuity passes to Megan without triggering an income tax consequence and she can let the money continue to grow tax-free for years to come AND at her personal income tax rate (which could be in her retirement years when she’s in a lower tax-bracket).

Use this to go after affluent clients!

Most CPAs are NOT proactive and most will NOT know this concept. For affluent clients who have money they won’t need before they pass away, this is a killer concept to introduce them to and a tool advisors can use to pick up more clients (and referrals from CPAs)!