Last week I let readers know about my speaking gig for the Yale Club as an “expert” speaker on IUL (Indexed Universal Life). Apparently, this study group is mainly made up of whole life Kool Aid drinkers; and I was “going into the lion’s den“ (meaning I’d get grilled on my positive IUL opinion).

While the presentation I created was really quite good, I was told an hour before the session that I was being UNINVITED! (yes, they cancelled me). Why was I cancelled? It’s because I sent a newsletter letting readers know I was speaking and allowing a download of the presentation. Apparently, they wanted my speaking gig to be kept a secret.

I told the Yale Club that this is why many have a dim view of “elite” institutions. Education on IUL is not meant for a select few. Its content that anyone who wants to learn should be able to view. I think it’s ridiculous for a study group to hinder education in any way, shape, or form.

To download the presentation I was going to use for the Yale Club, click on the following:

https://advisorshare.com/iul-yale-presentation

Huge 1035 Opportunities When IUL Carriers Dump Caps

A few weeks ago, I did a newsletter (with download) titled:

Actual IUL Historical Renewal Cap Rates (the info everyone has been waiting for)

To download the “renewal cap history” of the top 18 IUL carriers, click on the following link:

https://advisorshare.com/iul-renewal-cap-rates

I was a surprised the download was one of the most popular ones I’ve had in quite some time.

IUL companies dumping caps— our research made it clear that many companies dump caps on renewal. This is the #1 item that IUL haters point to as a problem. After our research, I’d have to agree that is it a problem with many companies.

200 North America (NOA) IUL products

We (our IMO www.advisorshare.com) are working with a few advisors who over the years have sold more than 200 NOA/Midland IUL policies. If you download the renewal cap piece, you’ll find that NOA renewal caps on older policies are some of the worst in the industry.

So….these advisors asked us to run in-force illustrations and compare the projected borrowing from the NOA policy to other alternatives.

When you run an in-force illustration showing what an IUL is projected to generate from a cash- flow perspective, you are stuck using the “current cap” not the much higher cap the agent used when illustrating the product at the point of sale.

1035ing to a Better IUL

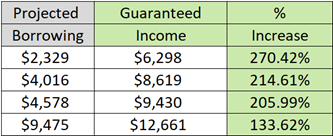

Here are a few examples we are reviewing for a possible exchange to a new/better IUL.

FYI, the carrier with the 12% cap has the best renewal cap history in the industry and the lowest it’s been in the last 10-years is 12%. FYI, the borrowing is projected annually from ages 66-90.

While a traditional 1035 into a new IUL can work for younger clients, they don’t typically work well for older clients. So, we looked at 1035ing into an FIA with a guaranteed income for life rider. As you can see, it worked like a charm to save the client from their current lousy IUL (the cash flow for these examples is immediate (they are older and need the cash flow)).

1035ing to a FIA with a guaranteed income rider

The above numbers are great, but remember, the cash flow form the IUL is tax-free and some of the cash flow from the FIA will be taxable.

Calculating the taxes depends on the premiums paid, if there is a gain, and the income tax bracket when income is received. The gain is going to be taxable. The following are numbers if 25% of the 1035 premium is treated as a gain and the client is in the 24% income tax bracket.

You know what I see when I look at the 1035 numbers for the older client into an FIA with income rider? I see a huge smile on both the client’s and the advisor’s face. The client will get a much better outcome, and the agent hopefully will avoid a lawsuit.

Do you have older IULs on the books with lousy renewal caps?

If so, feel free to contact Mitchell DeFrancesco at mitchell@advisorshare.com or 269-849-6669 to have him run 1035 numbers for you to see if it makes sense to get out of the underperforming IUL and into a better IUL or even an FIA with income rider.