To try OnPointe’s Risk Questionnaire for yourself, click on the following:

To learn more about OnPointe Risk, click on the following: https://onpointesoftware.com.

Not securities licensed? OnPointe has a “light” version at 50% of the cost for insurance agents.

In 2020, I wrote an article titled: It’s Time to Stop Ignoring (or underutilizing) Risk Capacity. If you haven’t read it, you can by clicking on the following link:

https://advisorshare.com/its-time-to-stop-ignoring-risk-capacity

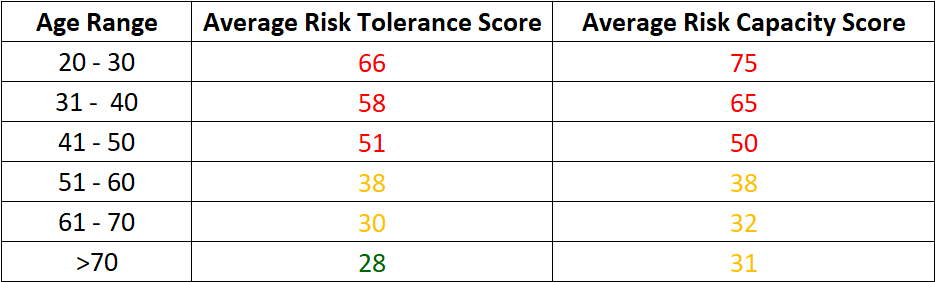

–Risk Tolerance—how clients “feel” about risk in the stock market.

–Risk Capacity—a client’s “financial ability” to take risk (it doesn’t matter how they feel).

Unlike Riskalyze/Nitrogen, OnPointe calculates BOTH tolerance and capacity (and OnPointe collects a LOT MORE INFORMATION in its questionnaire).

What’s interesting about these numbers? Averages for clients ages 51-70 are under 40.

FYI, a 60/40 stock-to-bond portfolio scores a 44.

Why do I find this interesting? Because most model portfolios we see advisors use for clients over 50 have risk scores in the 50s or higher. That’s one reason we rolled out the “Anti-TAMP” to give advisors high-quality “risk-adjusted” portfolios to offer clients (www.advisorstamp.com).

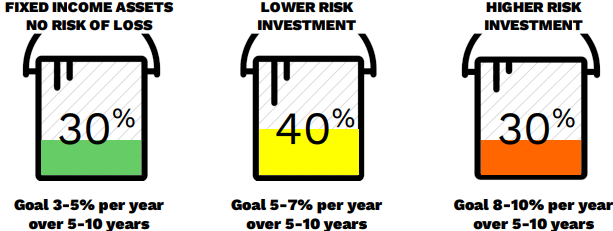

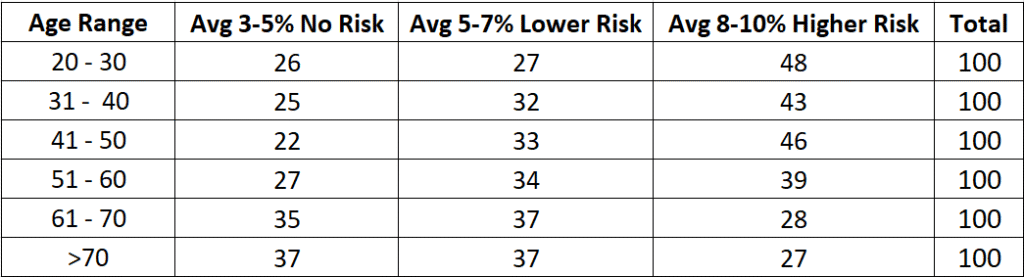

3-Bucket Approach

Unique to OnPointe is its use of a 3-bucket approach in the client questionnaire.

I think these stats are the most interesting in the client questionnaire. Nearly EVERY client puts something in bucket #1 (and the stats say on average 26% or more).

Bucket #1 is a Fixed Indexed Annuity (FIA). It’s not bonds, it’s not structure notes, etc. And the older a client gets, the more they allocate to buckets one and two.

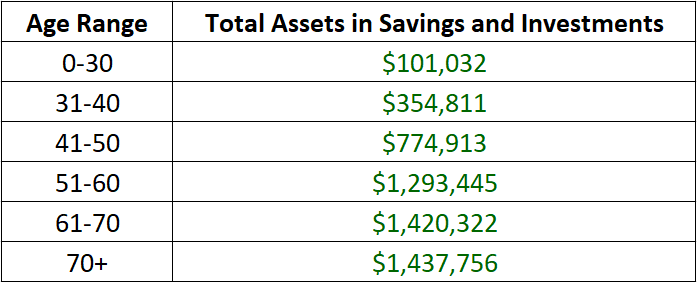

The following on total assets makes sense. Younger clients have less money than older clients. It also indicates that there are a lot of potential clients with $1 million or more!

Custom questions

The program allows users to add up to four custom questions…like is your estate plan in order, are you worried about LTC, are you interested in guaranteed income products, etc.

What can you take away from this newsletter?

If you are not using an online risk questionnaire with clients, you should be. It’s our IMO/RIA’s #1 point-of-sale tool advisors use to start discussions with potential clients about their money.

If you are using risk software and it doesn’t calculate the client’s risk capacity score, you should consider getting rid of it and using OnPointe.

For advisors who use FIAs as an asset class, it’s great that OnPointe’s questionnaire has the client telling you they think a significant amount of their money is in an FIA to hedge risk.

The client is telling you how much money they have (which is great to know) and when they anticipate needing it.

What more could you ask for in a risk questionnaire?