Live Demos—April 4th AND 5th at 2:00 p.m. EST

To see this new, powerful, and simple to use software live, click on the following:

https://onpointesoftware.com/live-demo

Can’t make the live demos? Email Lauren@onpointesoftware.com for a private demo!

Stop Wasting Time with Retirement Analyzer, E-Money, Right Capital, etc.!

If you are tired of spending 20-30-45 minutes to build out a client scenario in your current software, you are in for a treat. With the NEW OnPointe Retirement Planning software, we are not kidding when we say you can build out a retirement planning scenario in 5 minutes or less.

Industry’s Best, Most Powerful Charts, and Fully Interactive Charts

A picture is worth 1,000 words and not only are the charts powerful, but they are FULLY INTERACTIVE. You no longer have to schedule another session with your clients who want to see how different variableswill affect their plan. With OnPointe, you can change variables in real-time on the screen in front of them.

Integrate FIAs, FIAs with Income Riders, and IULs (tax-free borrowing)

OnPointe is the ONLY software in the industry that allows you to add an FIA (Fixed Indexed Annuity), FIA with guaranteed income rider, and tax-free cash flow from an IUL (Indexed Universal Life) to a plan. Doing so can help you hedge risk and extend retirement income for your clients.

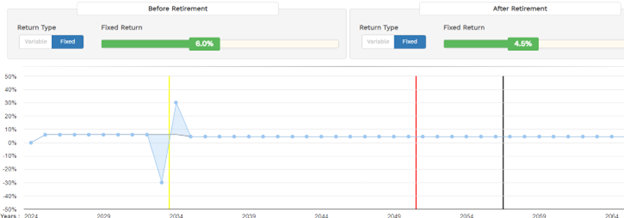

Best Sequence of Risk Return Illustration Capability

It’s vital to communicate how devastating a large drawdown in the market can affect their retirement income stream. With OnPointe, you can communicate this issue to your clients in less than 10 seconds and I guarantee that 100% of the time they will understand it (our interactive charts are incredibly powerful).

Retirement Income Gap!

How do you show value to clients? Show them how they are currently set up for a significant income shortfall in retirement and how you can help them reach their retirement income goals with your recommendations.

Example Charts

The first chart shows a client who thinks that their money will last until age 88!

The following is that same client’s cash flow when you assumed a –30% return the year before retirement followed by a positive 30% year. Notice that the client runs out of money at age 82 (without the up and down, the client would have run out of money at age 88).

With our sequence of risk return tool, you can show the 30% down/up in seconds on the screen. It’s the most powerful tool in the industry to show clients why their plan is NOT what their Wells Fargo or other advisor told them it would be when using a 95% probability Monte Carlo simulation.

It’s Impossible to Communicate the Value of OnPointe Retirement Planning in a Newsletter

If you want to see live for yourself how this software works, sign up to attend one of the sessions later this week. You will be blown away by the simplicity and power of the program .

The NEW DOL Regs are Coming and They are NOT Good for FIAs!

To download a 32-page PowerPoint by the top law firms that advises IMOs/insurance companies/BDs that breaks down the key issues on the new regs, click on the following link: