To sign up for info on this brand-new FIA , click on the following link:

https://advisorshare.com/new-income-rider-fia

Product Specs:

Option 1—9.75% compounded rollup on the benefit base.

Option 2—25% benefit base bonus with 6.75% compounding growth.

-Option 1 is for up to 10-year rollups.

-Option 2 is for turning income in early years.

There is an option for level OR increasing income when you turn on income.

Example 1: 60-year-old, $250k premium, 10-year rollup: level GIB for life = $42,404

Example 2: 65-year-old, $250,000 premium, 1-year rollup: level GIB for life = $22,945

You can check the above numbers with your favorite GIB FIA product (or VA or RILA).

FYI…

1) It’s with an A- rated carrier

2) It’s a limited distribution product (only select IMOs will have access)

3) It’s with a carrier that publishes their renewal caps (meaning the company has integrity)

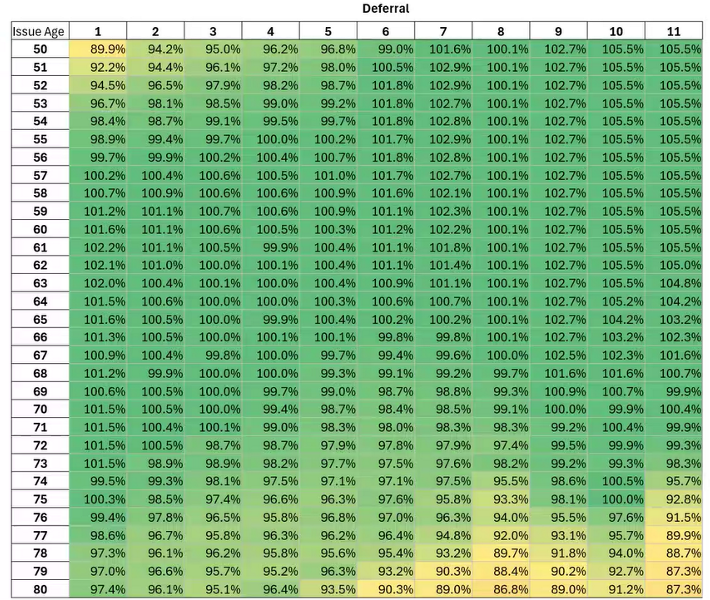

How good is this product? Green on the map shows where it is #1 in income. It’s insane how many times it’s #1 in income (usually an income product has a very small sweet spot).

Long-Term Income Care Doubler

Like many products, this product has an income doubler (for clients who can’t perform 2 of their 6 ADLs). However, the increased income continues to pay for the full five-year period even if the account value goes to zero unlike the following products:

-EquiTrust – MarketEarly

-F&G – Safe Income Advantage

-Athene – Ascent Pro 10 Bonus

-Am Equity – IncomeShield

-Corebridge doesn’t have an income doubler

OnPointe Retirement Planner

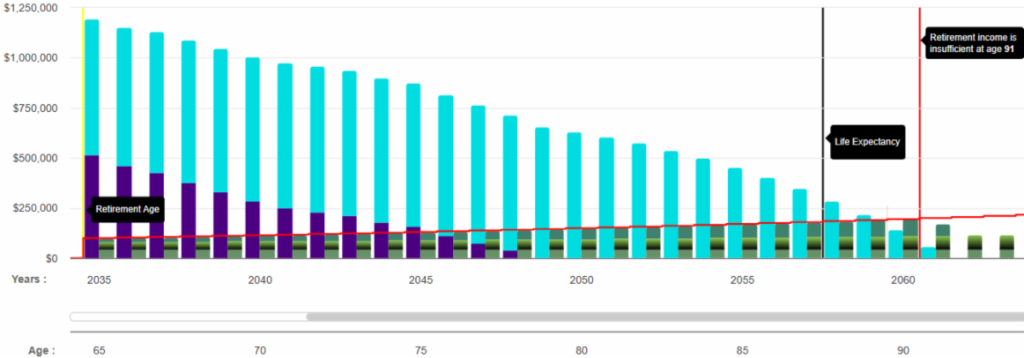

If you want to communicate the value of this NEW income rider FIA to clients, just add it to a retirement income scenario for clients in OnPointe. Nearly 100% of the time you are going to get a better outcome for the client (more retirement income).

To learn more about OnPointe Retirement Planner (including our brand-new Roth conversion app), click on the following link: