If you don’t believe in Fixed Indexed Annuities (FIAs) as a bond alternative, this will change your mind.

If you are using FIAs for growth (vs. income), this could be your new #1 product.

If you are using RILAs, you should be considering this FIA as an alternative.

Sign Up for More Info or to Attend Our Webinar

February 27th at Noon EST

To sign up, click on the following:

www.advisorshare.com/new-fia-for-growth

RILAs (Registered Indexed Linked Annuities) continue to gain popularity.

Why? Partial risk mitigation and “supposedly” more growth potential than an FIA.

RILAs are a buffered product with an upside cap:

1) Upside cap 13% (based on the S&P 500)

2) 10% downside buffer (if the index is negative more than 10%, the client takes that loss)

NEW FIA should outperform or significantly outperform RILAs

(and other FIAs in the marketplace)

FYI, this NEW FIA isn’t the simplest product to explain. I’ll explain the basics below, but I highly recommend you sign up to learn more or attend the webinar so you can learn more.

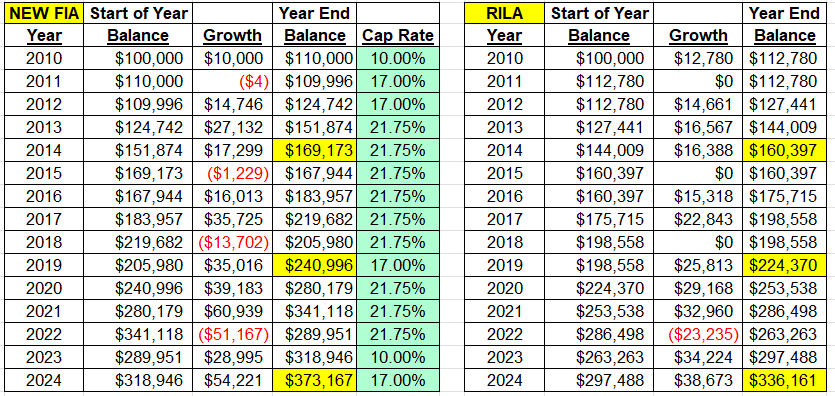

New FIA vs. RILA

Let’s start with a comparison. $100,000 premium at age 55. I’ll use the last 15 years of returns in the S&P 500 index (minus dividends). The starting annual cap rate on the FIA product is 10%. The RILA terms are the 13% annual pt-to-pt cap with a 10% downside buffer.

What jumps out at you?

1) The account values in years 5, 10, and 15 are higher with the FIA.

2) The cap rates are crazy high with the FIA (not stuck at 10%).

Which is better? Well, in a steady up-market, the FIA is going to beat the RILA every time.

What about the 2007 stock market crash? Let’s assume both the RILA and FIA have accumulated a $500,000 account value based on an initial premium of $250,000 from several years earlier.

What jumps out at you?

1) The RILA with a 10% buffer got hammered when the SPY was down 55% (down 45%).

2) The FIA did lose 15% of its value, but it wasn’t as painful and regaining its value will be easier (when down 15% you need 18% to get even; when down 45% you need 82% to get even).

Trail commissions—this FIA comes with a 1% trail option (similar to a RILA).

Unique Product Design

Risking negative returns in an FIA

FIAs are normally a NO RISK product designed to generate 4-6% returns over time.

In this NEW FIA, the owner can lose some of the credited growth in down years.

Why would you want to potentially risk losing some of your growth?

The only reason is if you could generate significantly higher returns over time.

How does it work? The client can choose to risk up to 15% of their account value annually.

AT NO TIME CAN THE CLIENT EVER GO BELOW THE INITIAL PREMIUM AMOUNT. ALSO, AFTER X NUMBER OF YEARS, THE GUARANTEED ACCOUNT VALUE WILL START LOCKING IN AT HIGHER VALUES THAN INITIAL PREMIUM VALUE.

What does the client get for the risk? Higher PAR or cap rates in investment index!

Graduated increases—the increase in the PAR or cap rate happens incrementally until the max cap rate of 21.75% is reached along with the maximum risk of 15% of the account value (again, risking only gains not the initial account value).

Summary of the highlights of this new FIA:

–A-Rated carrier that has published their renewal rates since 2015

-Offers a 10% S&P 500 annual cap or competitive S&P 500 1-yr PAR rate (with no cap)

-Clients only risk gains instead of principle

-Annual S&P 500 caps can grow to 15%, 18%, and even 21.75%

-This is a NO-fee product

-Can come with or without a premium bonus

If you are currently selling FIAs and are looking for a product with the potential for significantly higher growth…if you are currently selling RILAs and want a more protective product that is designed for higher growth…if you are not using FIAs as a bond alternative….

Then you should sign up to learn more about this new FIA product!