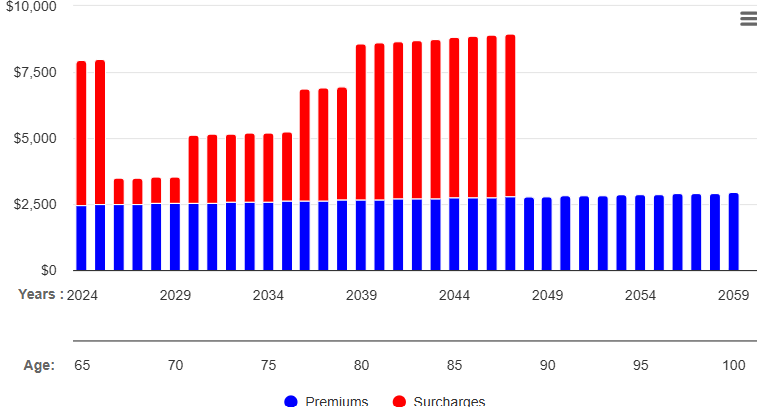

Medicare premiums are expected to rise substantially! The following are from the 2024 Medicare Trust Fund Report as it pertains to projected cost increases:

Medicare Part B:

-2024–2033: Projected average annual increase = 8.2%

-2034–2048: Projected average annual increase = 5.5%

-2049–2098: Projected average annual increase = 4.2%

Medicare Part D: These premiums are minor and they are as follows for the same time frames: 6.4%, 3.6%, and 4.5% respectively.

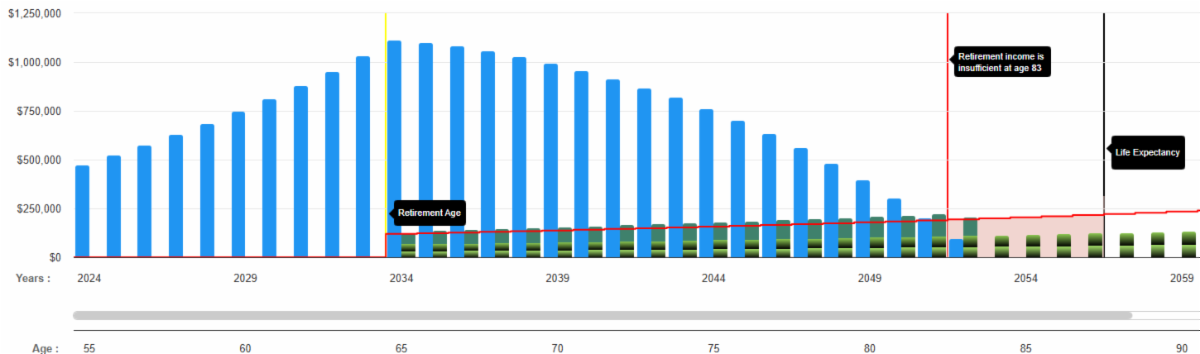

What’s the big deal? Let’s look at a married 55-year-old couple example and it should crystalize why all but the affluent are NOT financially prepared to pay their Medicare premiums.

–MAGI of $150,000

–$475,000 in a tax-deferred 401(k) and are saving $20k a year into the 401(k)

–$35,000 Social Security payment per spouse starting at age 65

-They want to spend $120k cash starting at age 65 (the year they retire)

If you DO NOT factor Medicare premiums into their retirement plan, they run out of money at age 88 (their expected age of death).

The following is what happens when you SUBTRACT projected Medicare premiums from their $120k desired cash flow starting at age 65 (I ONLY used a 5% inflation factor for the premiums).

They run out of money at age 83. Notice the huge income retirement gap in their plan.

What are the projected Medicare premiums for this couple up to age 88?

$179,367 per spouse for a lifetime total of $358,734!

Most financial planners are NOT budgeting Medicare premiums into client retirement plans. Why? Retirement planning software most advisors use doesn’t calculate these premiums (or if it does, they are not done correctly).

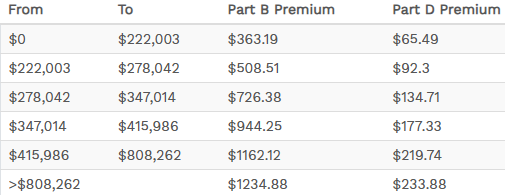

And this example had no IRMAA penalty. If this example client had a higher MAGI, the following are the projected baseline Medicare premiums at age 70. Premiums above the $363.19 baseline premium = the IRMAA penalty.

What jumps out about the above chart?

-The baseline Medicare premium is $363.19 per spouse/per month (no IRMAA penalty)

-With $278,042 of MAGI, the monthly premium is $762.38 ($363.20 IRMAA penalty)

So, for this moderately affluent married couple, the age 70 Medicare premium = $20,066!

Summary

If you are NOT budgeting in the significantly increasing Medicare premiums into your client’s retirement plans, then how can they be accurate?

FYI, we’ve reverse- engineered just about every financial planning software and do you know how many we believe correctly calculate the Medicare premiums and IRMAA penalty?

ZERO! (And that includes Retirement Analyzer, MoneyGuide Pro, and even E-Money).

If you are using your own self-built retirement Excel spreadsheet, again, it would be nearly impossible to correctly calculate these numbers and add them to plans in a realistic manner.

Unmask Hidden IRMAA Penalties with OnPointe Retirement Planner

Once you learn about the IRMAA penalties, you’ll want to be able to calculate it for clients. As shown in this newsletter, OnPointe Retirement Planning software calculates the projected Medicare premiums and IRMAA penalty. The ability to illustrate these numbers is a KILLER lead gen tool.

Watch a video of how to calculate the IRMAA Penalty in OnPointe—click on the following:

https://onpointesoftware.com/irmaa-calc

Advisor-Branded Client Piece

Want to introduce IRMAA to clients/leads 55 and older? We created a 1-page summary that an advisor can personally brand. To download this customizable piece, click on the following: