JP Morgan and Transamerica released NEW retirement studies that included data on how much retirees actually spend vs. what they thought they would spend. The conclusion, surprisingly, is that many people spend LESS than what they thought they would spend.

To download both of these studies (great for clients use), click on the following:

https://advisorshare.com/retirement-spending-downloads

Most advisors have some amount of focus on “retirement planning.” I felt so strongly about retirement planning that we built the OnPointe Retirement Planningsoftware (the 5-Minute Retirement Plan™). If you are using Retirement Analyzer, E-Money, MoneyGuide Pro, etc., and you have not checked out OnPointe, you should. It’s the simplest and most powerful software of its kind.

Why are these studies important? These two studies will help facilitate a different discussion with your clients about how much they truly need to save for retirement.

JP Morgan—this study looked at more than 280,000 households (a huge number) and here are some highlights from the study:

- More than half of the households (couples) did not retire all at once (one spouse retired early or one spouse continued to work part-time).

- Partially retired households tend to spend MORE than their fully retired peers.

- Many households who had less than $150k pre-retirement income had a spending splurge in the few years after retirement.

- Older households (65+) spend more on health care and charitable gifts, but SIGNIFICANTLY LESS on everything else.

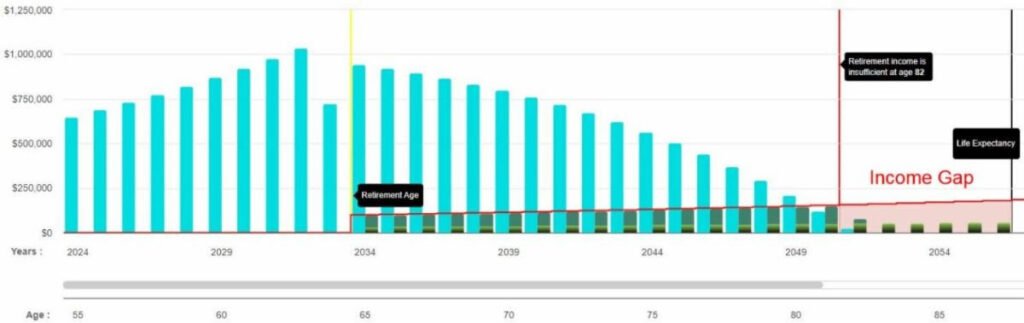

The following chart is what got my attention. See the downward trend in spending.

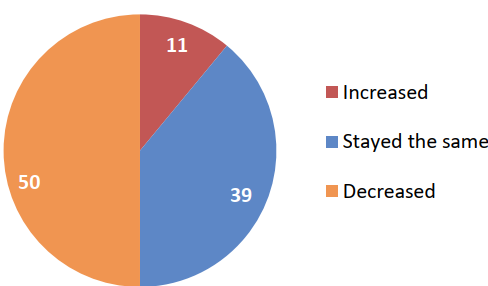

Transamerica (Nov 2024)—this study is of those already retired. The key takeaway for this newsletter is that 50% of those surveyed said their expenses since retiring have DECREASED!

This study is 77 pages long. It has a lot of interesting info such as:

-Positive or negative word association with “retirement” (68% chose “freedom” as a positive word and “health decline” as the top negative word)

-Top retirement priorities

-How life has changed since retiring

-Retirement dreams vs. reality

-Caregiving experience (like caring for parents, spouses, other family members or friends)

-Actual retirement age

-Did you retire sooner, later, or at the expected age (most retired sooner)

-Retirement confidence

-Financial priorities (paying off debt was #1)

-Age you started Social Security Benefits (median age is 63)

-Greatest retirement fears

Both of these studies are interesting and come loaded with useful info that advisors can use to better understand their clients and help them give better retirement planning advice.

OnPointe Retirement Planning Software

When I survey advisors about the financial planning software they are using, most say it’s just ok or is not very good. I agree which is why our OnPointe programming team worked for over two years to build our industry-best OnPointe Retirement Planning software.

If you are tired of spending 20, 30, or 40 minutes to build out a retirement plan in software so you can create a 30-, 40-, or 50-page report that clients won’t read, isn’t it time you made a change?

OnPointe is the best software in the industry to illustrate “sequence of return risk” to clients, it comes with the industry’s most accurate IRMAA calc and Roth conversion calc, and it can incorporate FIAs, FIAs with income riders, and IULs into retirement plans. To check it out click on the following:

https://onpointesoftware.com/retirement-planner-software