It’s been a while since I covered an investment strategy, so I thought I’d do one this week on a very interesting Risk On/Risk Off (RORO) strategy.

RORO is available on the “Anti-TAMP”

I’m not just covering this as an FYI; this strategy, and many others, are available right now on our “Anti-TAMP” platform www.advisorstamp.com.

On-Demand Overview Webinar

& Download the Fact Sheet

By: Joe Maas, CFA, CFP®, ChFC, CLU®, MSFS, CVA, ABAR, CM&AA, CCIM

This strategy was designed and is managed by Joe. If you would like to view a video explaining how the strategy works and to download the fact sheet, click on the following link:

www.advisorstamp.com/roro-webinar

Gross return in 2025 27.83%

Gross return in last January 2026 8.23%

The S&P 500 returned 17.72% in 2025 and 1.47% the January 2026.

Why are clients paying you to manage their money?

Most would say to generate returns that are in excess of the benchmark. Why? Because if an advisor can’t beat the benchmark, then why are clients paying for the service? This RORO strategy is exactly the type of strategy advisors should be looking for to provide “unique” value to their clients and justify their fees.

RORO Summary Description—this strategy adapts to changing market conditions by rotating between growth-oriented and defensive positions across a broad universe, including U.S. and international equities, fixed income, commodities, currencies, and emerging opportunities such as digital assets.

Construction Methodology—A three-step process:

1) Universe Definition – identify the investable set of global assets.

2) Quantitative Screening – evaluate securities based on momentum, relative strength, and risk-adjusted performance.

3) Capital Allocation – implement portfolio weights to top tickers according to screening results and risk parameters.

Portfolios are monitored and rebalanced monthly to maintain alignment with market trends.

Dynamic Risk Regime Allocation (DRRA)—DRRA evaluates global assets using proprietary momentum and relative strength metrics. High-performing, risk-adjusted assets are prioritized, while weaker or stressed securities are systematically excluded. By combining rigorous analysis with tactical flexibility, the RORO strategy seeks to capture opportunities in both rising and falling markets, offering a differentiated and risk-aware approach to portfolio management.

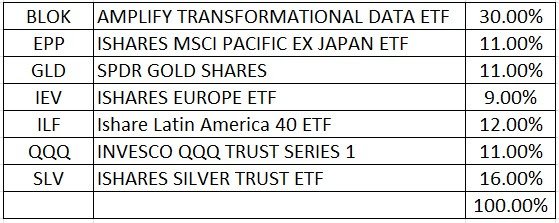

Example of Recent Holdings

January 2026

September 2025

I highlighted September because I thought BLOK at 30% was an interesting choice. BLOK was up 12.63% in September and helped the portfolio mix to a 9.39% positive return for the month when the S&P 500 was up 3.56%. FYI, BLOK only stayed in the portfolio for another month.

What’s also useful about this strategy is it can go anywhere to seek returns or mitigate risk. You notice gold, silver, Latin America, Japan, Europe, digital assets, etc. So, while your current portfolios/strategies may mainly be U.S. based, RORO will give your clients exposure to all asset types from around the world.

What Makes your AUM Offering Unique?