Right now, there is one clear leader in the “immediate” income space for Fixed Indexed Annuities (FIAs). After reading this, you may want to learn about the FIA with guaranteed income benefit (GIB) rider used in this newsletter. To do so, click on the following link:

The thought that a GIB rider annuity could generate more IMMEDIATE/LIFETIME income than a SPIA (Single Premium Immediate Annuity), in the past, has really been unthinkable.

Why unthinkable? Because a SPIA has no cash value and should be able to generate more income than a product with a cash surrender value.

But this just shows you how far GIB rider FIAs have come.

Type of SPIAs: 1) Life-only payment; 2) Period certain; 3) Life with a period certain

Let’s Look at an example that will crystalize a comparison of FIAs with GIBs to SPIAs.

I ran numbers for a 65- and 70-year-old. The SPIA examples are life-only and life with a 10-year period certain (so if the client dies early the payments continue). For the FIA, I simply turned the income rider on at issue. Let’s look at the lifetime payments.

| FIA with GIB | SPIA Life Only | SPIA with 10 year preiod certain | |

| 65-year old 70-year old | $23,940 | $23,604 | $22,919 |

| 70-year old | $26,145 | $26,950 | $25,558 |

For the 65-year-old, the FIA generated slightly more income.

So what? The FIA has an account value that pays as a death benefit. As such, why would an advisor EVER recommend a life-only SPIA if an FIA with an account value generates more income? They shouldn’t unless the income is substantially higher.

What about the 70-year-old? The life-only SPIA paid more. But what happens if the client dies after 1, 5, or 7 years? The beneficiaries get ZERO! With the FIA, there will be an account value.

What about an SPIA with a 10-year period certain payment? A SPIA with period certain payment is used to avoid having someone die early and then leaving nothing to the heirs. If that’s the case, the heirs would be MUCH better off with the death benefit from the GIB FIA.

Let’s look at the 65-year-old example if the client dies after 5 years of payments—

-Life-only SPIA—client dies, and the heirs get ZERO!

-Life SPIA with 10-year period certain—heirs receive $114,590 of additional payments.

-FIA with GIB—account value (death benefit) = $158,527!

By the way, in year 11, the death benefit value of the FIA is $34,807.

The caveat with the FIA is that the account value is driven by the returns. FYI, the FIA in this example has a current cap of 10.75% (with 5% bonus) on the annual pt-to-pt/S&P 500 (minus dividends) crediting method (with a company that has a very good renewal cap history).

Commissions

Advice should NEVER be given based on commissions, but it is nice that with the FIA sale, the commission for the advisor is 6.5% with the FIA vs. 3% with the SPIA. So, double the revenue for the advisor, more income for the consumer, and a better outcome if the client dies in the early years.

Are you using FIAs with income riders instead of SPIAs for your clients? Most advisors are not and the blame for that goes to….the IMO advisors work with.

Is your IMO helping you make the best product recommendations?

As you may know, because I think most IMOs suck at what they do, I created an IMO whose primary focus is making sure advisors are providing the best recommendations to clients.

So, if you want to learn more about an IMO that is client-focused and where you can get OWNERSHIP with production, go to www.advisorshare.com to learn more!

Best illustration software for GIB FIAs

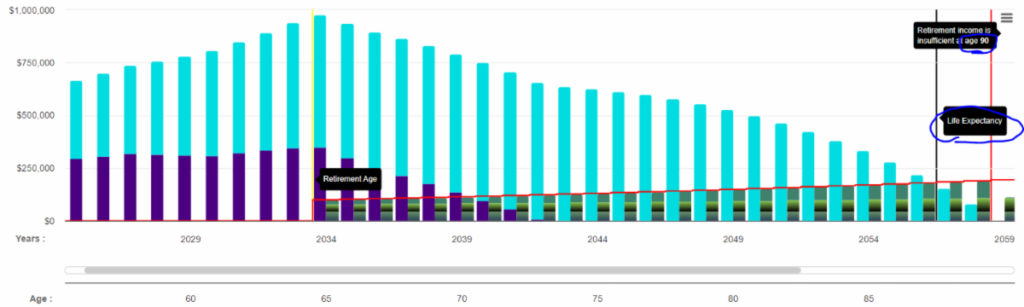

If you want to show your clients the power of using an FIA with a GIB rider to visually and mathematically show them how such products can guarantee a portion of their retirement income and extend their income years longer in retirement, check out our OnPointe Retirement Planning software.

OnPointe is light years ahead of programs like Retirement Analyzer, E-Money, MoneyGuide Pro, etc. when it comes to illustrating GIB rider products to clients.

If you want to watch a video of how easy it is to build an FIA with GIB in a client fact pattern and how that product extends their income in retirement, click on the following link:

www.onpointesoftware.com/income-riders