Once you learn about the IRMAA penalty, you’ll want to be able to calculate it for clients. OnPointe Retirement Planning software just added the ability to calculate the projected IRMAA penalty for clients. This UNKNOWN but PUNISHING issue is going to be a KILLER lead gen tool.

Watch a video of how to calculate the IRMAA Penalty in OnPointe—click on the following:

Advisor Branded Client Piece

Want to introduce this IRMAA to clients/leads 55 and older? We created a 1-page summary that an advisor can personally brand. To download this customizable piece, click on the following:

Why All Advisors Need to Learn about the IRMAA Penalty!

What makes for a great marketing topic (to get clients to talk with you)?

How about a topic that…

-clients are not aware of and one that can cost some $100,000+ in retirement.

-most advisors are NOT familiar with and are NOT helping their clients with.

Do you know what IRMAA is?

As I talk more and more about IRMAA with advisors, it’s clear that MOST do NOT!

What is IRMAA (Income-Related Monthly Adjustment Amount)?

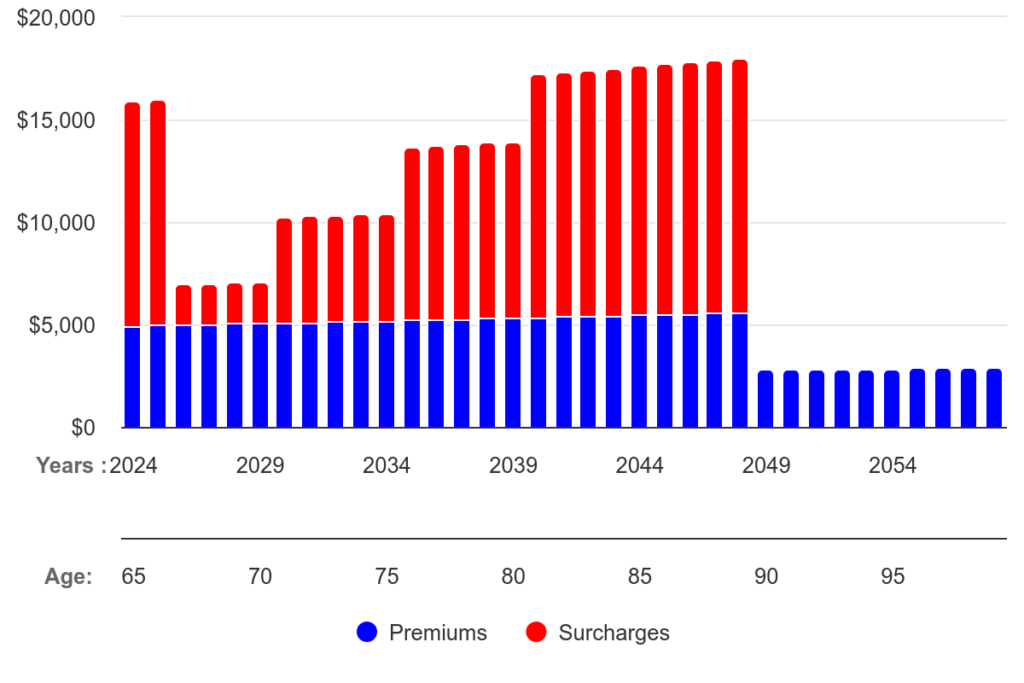

IRMAA is the additional premiums taxpayers are charged for their Medicare Part B and Part D premiums.

Medicare Part B covers non-hospital charges (doctor visits, lab work, etc.).

Medicare Part D is your prescription drug coverage.

Turning 65—when people turn 65, they will apply for Medicare. Premiums charged for the Part D and B coverage vary depending on your MAGI (Modified Adjusted Gross Income). The more you make, the more you pay (it’s like a progressive stealth tax)!

How much is the penalty? It’s anywhere from 70%-340% of the base Medicare premium.

For example, in 2024, the baseline Medicare Part B premium is $170.70 per month.

-If a client is bumps up one penalty bracket, the premium goes up to $244.60 per month.

-if the client is bumped to the top penalty bracket, the premium is $594 per month.

If a client is subject to the IRMAA penalty, how is that paid?

It’s automatically deducted from your Social Security check. For clients who have no idea that they are subject to an IRMAA penalty, this will be a real SHOCK!

Will Consumers Want to Know if They are Projected to Have an IRMAA Penalty?

Absolutely! Advisors who not only can run IRMAA numbers for clients but can also help them plan to mitigate the problem will be in the cat bird’s seat when it comes to picking up new clients.

How do you mitigate the IRMAA penalty? Help the client lower their MAGI in retirement.

What tools can you use? If you plan early enough (clients 55 and younger or 60 and younger if affluent), you can use cash value life (Indexed Universal Life).

Roth IRA Conversions

Roth conversions can help some clients mitigate or avoid the IRMAA penalty.

OnPointe is about ready to roll out its Roth conversion software. It will be out in a few weeks, and it will be dramatically different than any other conversion software in the industry (meaning it will be much, much more accurate).

When it rolls out, when doing a Roth IRA conversion, not only will OnPointe create the most accurate numbers determining if a conversion makes sense, but it will also determine if the conversion will CREATE an IRMAA penalty.

The bottom line….

Advisors who talk about IRMAA will set themselves apart and will be able to start discussions with many more clients ages 55-65 than they could ever dream of talking with when talking “products.”